rhode island tax rates 2021

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. 2 weeks ago A majority of US.

Tobacco Use In Rhode Island 2021

About Toggle child menu.

. Detailed Rhode Island state income tax rates and brackets are available on this page. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately. FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020 Represents tax rate per thousand dollars of assessed value.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Payments will be sent to nearly 115000 Rhode. Published on Monday December 20 2021.

Any income over 150550 would be. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI.

If youre married filing taxes jointly theres a tax rate of 375. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The UI taxable wage base will be 24600 for most employers and 26100 for employers.

Your average tax rate is 1198 and your. The rates listed below are either 2021 or 2020 rates whichever are the latest available. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

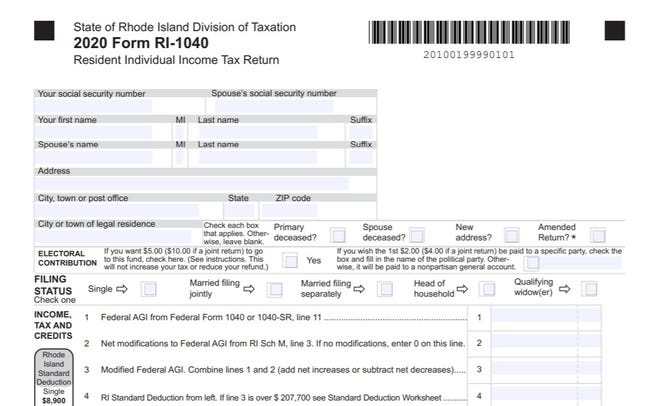

Detailed Rhode Island state income tax rates and brackets are available on this page. TAX DAY IS APRIL. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Exact tax amount may vary for different items. TAX DAY IS APRIL. 2021 Rhode Island Property Tax Rates Town by Town List Rhode Island Property Tax Rates vary by town.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Some of the most. The table below shows the.

State of Rhode Island Division of Municipal Finance Department of Revenue. DO NOT use to. Below is a complete list of Property Tax Rates for every town in Rhode Island.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. It kicks in for estates worth more than 1648611. Compare your take home after tax and estimate.

Rhode Island Tax Brackets for Tax Year 2021. Rhode Island Income Tax Calculator 2021. Start filing your tax return now.

If you live in Rhode Island and are thinking about estate planning this. 2022 Rhode Island state sales tax. Assessment Date December 31.

Start filing your tax return now. The customer must give you a completed Rhode Island sales and use tax resale certificate or one of several types of exemption certificates issued on or after July 1 2021. The rebates are available to Rhode Island residents making up to 100000 a year for individual filers and 200000 for joint filers.

Outlook for the 2023 Rhode Island income tax rate is to remain unchanged with income tax brackets increasing due to the annual inflation adjustment. States have an additional capital gains tax rate between 29 and 133. The top rate for the Rhode Island estate tax is 16.

We last updated Rhode Island Form IT-95 in March 2022 from the Rhode Island Division of Taxation. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Rhode Island Estate Tax Everything You Need To Know Smartasset

Rhode Island Income Tax Brackets 2020

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Income Tax Calculator Smartasset

Map Of Rhode Island Property Tax Rates For All Towns

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Free Rhode Island Tax Power Of Attorney Form Pdf

Ri Health Insurance Mandate Healthsource Ri

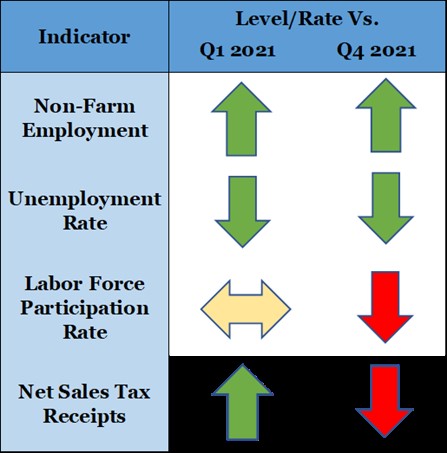

Ripec Bryant Report R I S Gdp Grows For 3rd Straight Quarter

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

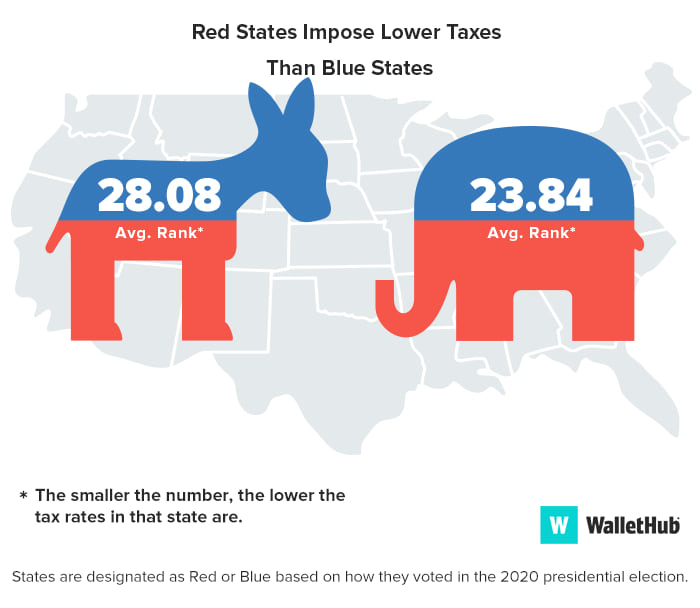

States With The Highest Lowest Tax Rates

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Ri State Tax Calculator Community Tax